Is your charity missing out on donations of securities and mutual funds?

These gifts are one of the most tax-smart and efficient ways donors can make charitable donations in Canada. Donations of securities are typically larger than cash donations, and because donors don’t have to pay capital gains tax on the appreciated value when donated directly, your charity receives a greater benefit, and the donor receives a larger receipt. Learn more about charitable tax credits here.

Educate your donors on the advantages of securities and mutual fund donations

For your charity, this is an opportunity to super-serve your donors by educating and empowering them to give strategically (ultimately giving more).

Here’s how it works:

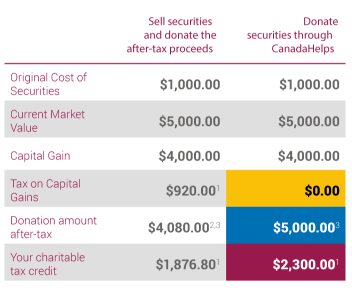

If a donor were to sell their securities or mutual funds and then donate the cash to your charity, they would be responsible for paying capital gains tax on the appreciated value—meaning the amount of money they have available to donate is less. But if they arrange to donate the securities directly to your charity, they will receive a tax receipt for the full value of the shares at the time of sale, and your charity will receive the full value of the gift with nothing lost to taxes.

Here are some approximate figures to illustrate:

The above chart assumes a 46% marginal tax rate. This is for illustrative purposes only and does not constitute legal or financial advice. Seeking professional advice before deciding upon your donation strategy is recommended.

Easily get set-up with CanadaHelps.

Your charity can create its own Letter of Authorization and establish a relationship with a broker to facilitate the service. For some, working on these transfers with your broker and ensuring you are onside with the charitable tax rules for these types of gifts may be daunting and time-consuming. If that’s the case, there is another option: CanadaHelps.

Since 2008, CanadaHelps has operated as Canada’s largest online facilitator of donations for gifts of securities. As a charity, with a free CanadaHelps Charity account, you can leverage this platform to begin accepting these gifts in minutes getting your “Donate Securities” button for your website that initiates a donation of this type to your charity. When a donation of securities is made to your charity, CanadaHelps will handle the process from beginning to end, issue a charitable tax receipt, and transfer the proceeds right into your charity’s bank account less its low non-commercial fee.

So you’re set-up. What’s left to make your securities appeal a success this holiday season?

Make your appeal! You can use all the proven techniques for your other appeals, highlighting the impact your organization can make with this gift. With that said, here are a few tips specific to this type of appeal:

- Segment your supporters addressing this appeal to your high value donors, and often older mid-value donors.

- Make an appeal, reinforcing the benefits of securities donations. You can find helpful, ready-to-go securities messaging and graphics here.

- Create a sense of urgency by tying your securities appeal and messaging to end of year tax time by including a time-sensitive cut-off for initiating their gift to ensure a 2017 tax receipt (ensuring there’s time to complete even more complicated sales).

This giving season, help your donors stretch their giving dollars by donating securities instead of cash. You’ll help them save money on their tax bill, and as a charity, you will enjoy the benefits of a substantially larger gift.

The 2017 deadline for donating securities and mutual funds through CanadaHelps is Monday, December 18th. Don’t miss out on these larger gifts this holiday season!

Leave a Reply