Since 2008, CanadaHelps has proudly been accepting and facilitating donations of securities and mutual funds. And now, there has never been a better reason or time to donate securities, as we have just lowered our fees on these donations!

Since 2008, CanadaHelps has proudly been accepting and facilitating donations of securities and mutual funds. And now, there has never been a better reason or time to donate securities, as we have just lowered our fees on these donations!

A donation of securities or mutual fund shares is the most efficient and tax-smart way to give charitably. CanadaHelps is the largest processor of online security and mutual fund donations in Canada. And, best of all, we make it easy to disburse your donation across multiple charities without any extra paperwork.

The Benefits: Save More, Give More

The benefits of donating publically traded securities instead of cash may be the savvy investor’s best kept secret. Since the elimination of the capital gains tax on securities donations in 2006, it has been the most tax-efficient way to support your community and reduce your tax bill!

When you sell your shares for cash, you’re responsible for the tax due on the gain, even if you plan to donate the proceeds from the sale. If you pay the tax out of those proceeds, there’s less money left to donate. Your charity receives a smaller donation and you have a smaller donation to claim for your charitable tax credit at the end of the year.

But when you donate your securities directly through CanadaHelps, those capital gains aren’t subject to tax. This means your charity receives a larger gift, and you’ll benefit from a tax receipt for the full value of your eligible securities or mutual funds.

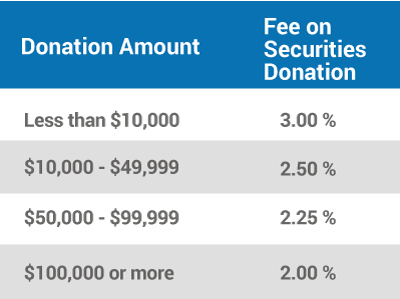

Our New Securities Pricing

Regardless of which charity or charities you give to, our new simple tiered pricing, ranging from 2% to 3% applies.

Securities Donations Tiered Pricing

On CanadaHelps.org, you can give to any of Canada’s 86,000 registered charities, big or small, and it’s as easy as filling out an online form and then authorizing your broker. Securities are transferred to CanadaHelps, subsequently sold, and the funds are sent to the charity – or charities – of your choice. If you own a large number of securities and aren’t prepared to donate the full value, you can still give a portion and cash-out the rest.

To learn more about the benefits of donating securities through CanadaHelps, click here.

Ready to make a donation of securities or mutual funds? Click here to get started!

Leave a Reply