Try Our Charitable Tax Calculator

Make the Most of Your Charitable Tax Credits

Not only is giving to charity a great way to make a difference to your favourite cause, but when you claim your charitable tax credits you can also take advantage of federal and provincial government tax incentives.

Explore the Financial Benefits of Charitable Giving

Federal and Provincial Donation Tax Credits Add Up

By donating to your favourite charity, you may receive as much as a $550 non-refundable tax credit on a total of $1000 donated in a single year, in some provinces.

Instant Tax Receipts, Anytime

CanadaHelps automatically emails you a copy of your tax receipt each time you make a donation – whether you have an account with us or not. Your receipts are stored securely in your account so you can access them at any time. You can download multiple receipts for each transaction or get one receipt with all your donations listed.

Don’t have an account? You can access receipts for up to 7 years using our receipt download tool.

All You Need for Tax Time

The Canada Revenue Agency (CRA) does not require a paper copy for your tax submissions! Simply keep the digital receipt we emailed you right after your donation or save your receipts with our receipt download tool or by logging into your account.

Create a Strategic Giving Plan

Don’t get caught by the December 31 deadline! Use your CanadaHelps account to plan your giving for the year. Set up a monthly gift that is more manageable for your budget, track your donations, and set giving goals for your year.

Maximize Tax Benefits

Reduce Capital Gains Taxes

In most cases, donating appreciated stocks, mutual funds or stock options means you pay no tax on the capital gains. Or save your charitable tax credits for future tax returns within 5 years of the transaction.

Carry Previous Donations Forward for a Larger Tax Credit

You do not have to claim all of the donations you made in the year they were made. When you donate over $200, you are automatically eligible to carry them forward and claim them on your tax return for any of the next five years. This flexibility means that the unclaimed carry-forward portion may qualify for a larger tax deduction, in the future.

Transfer Donation Credits to Your Spouse or Common-Law Partner

The donation tax credit is a non-refundable tax credit which means other tax credits must get claimed first to bring your tax payable to zero. If you cannot claim your donation amount on your tax return, pool your donations with your partners for a larger tax credit on their tax return.

Frequently Asked Questions

How do I claim a charitable tax credit?

Report it on your electronic federal and provincial tax return or on schedule 9 of paper tax returns. Generally, at the federal level, you are credited 15% of the first $200 of donations and 29% of additional donations above the first $200. Provincial donation tax credits on the first $200 and amounts above the first $200 range between 4% to 25%.

How much can I claim on my tax return?

In one year, you can claim a maximum of 75% of your net income. The ability to carry forward charitable donation credits means if you reach the maximum claim amount this year, you can always claim amounts left over next year.

Will you mail my tax receipt(s) at the end of the year?

At CanadaHelps, we don’t mail paper tax receipts. As a registered charity dedicated to increasing charitable giving, we strive to ensure that as much of every dollar we collect goes directly to supporting our mission. One of the ways we achieve this is by sending tax receipts via email, which helps us keep costs down and maximize your impact. You’ll be pleased to know that the CRA does not require a paper copy for your tax submissions! Simply keep the electronic copy of the receipt we emailed you right after your donation. If you need another copy of your receipt(s), you can easily log in to your donor account or use our Receipt Download tool.

I want more than one tax receipt for all of the donations I make. How can I do that?

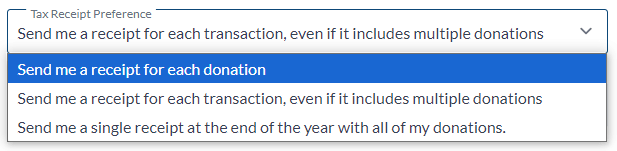

If you have a Donor Account on CanadaHelps.org, you can choose from a few different ways how you’d like to receive tax receipts for your donations, including:

The options can be found either in your Giving Basket page (upon checkout), or you can permanently save your tax receipting preference by visiting the Account Settings of your CanadaHelps donor account. Please note that existing tax receipts cannot be amalgamated or split once they’ve already been issued for a donation. Modifying your tax receipt preferences (above) will only apply to future transactions.