The Giving Report

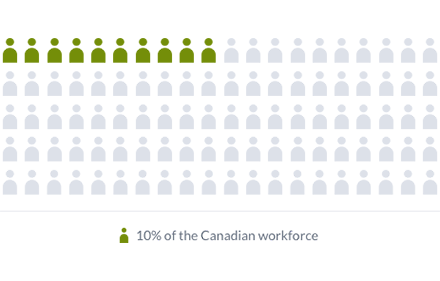

Charities are economically vital.

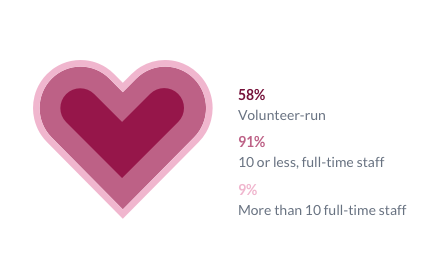

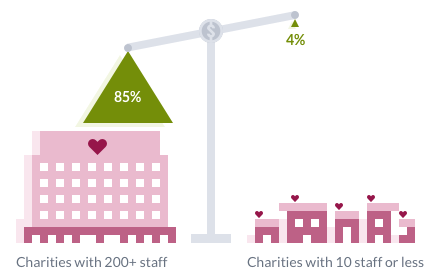

Most Canadian charities are small.

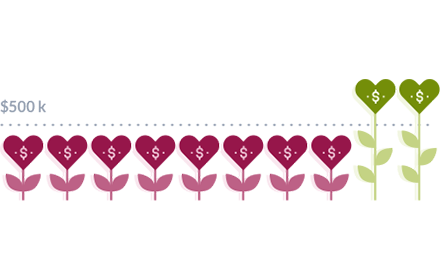

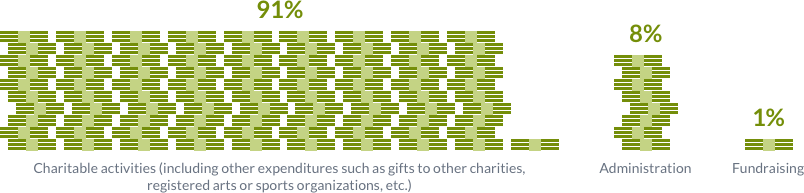

Less than 10% of charitable expenditures goes to administration costs, including overhead and fundraising.4

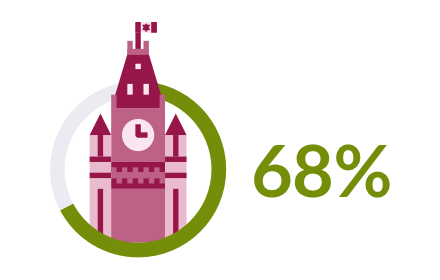

Government funding is crucial. Certain charities get most of it.

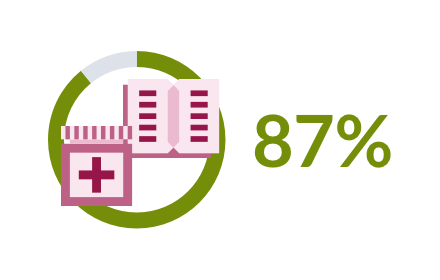

Small charities depend more on donations.

Appendix A: Data Sources and Clarifications

Throughout The Giving Report 2018 site, downloadable report and accompanying data tables, we include a reference number indicating the data source. Information on each data source, and relevant disclaimer or clarification information, is provided below.

Unless otherwise stated, all dollar figures are adjusted for inflation using constant 2016 dollars using Statistics Canada, Table 11-10-0047-01.

DATA SOURCE 1:

Johns Hopkins Universtiy, The State of Global Civil Society and Volunteering (http://ccss.jhu.edu/wp-content/uploads/downloads/2013/04/JHU_Global-Civil-Society-Volunteering_FINAL_3.2013.pdf)

DATA SOURCE 2:

Statistics Canada, Table 36-10-0478-01

Statistics Canada, Table 36-10-0438-01

Analysis by Imagine Canada

DATA SOURCE 3:

Canada Revenue Agency, T3010 Registered Charity Information Return

Statistics Canada, Table 14-10-0090-01

Analysis by Imagine Canada

DATA SOURCE 4:

Canada Revenue Agency, T3010 Registered Charity Information Return

DATA SOURCE 5:

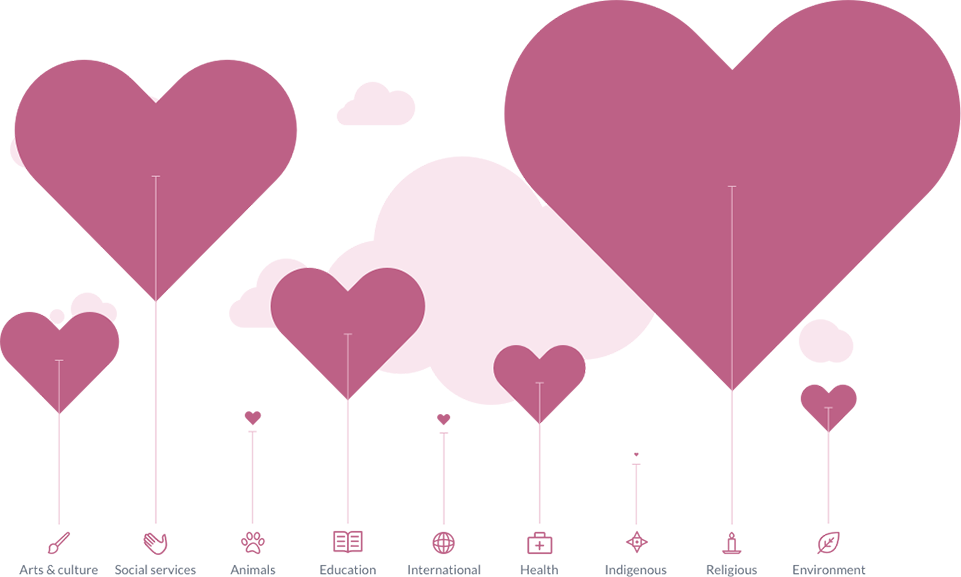

CanadaHelps

Note: Distributions do not sum to 100% as some charities may identify in multiple categories (e.g. a charity for education in visual arts may identify as an Arts & Culture charity as well as an Education charity)

DATA SOURCE 6:

Canada Revenue Agency, T3010 Registered Charity Information Return

International Classification of Non-profit Organizations

Imagine Canada, Grant Connect

DATA SOURCE 7:

Statistics Canada, Income Statistics Division, Annual Income Estimates for Census Families and Individuals (T1 Family File), Custom Tabulation

Postal Code Validation Disclaimer: The geography in T1FF request are derived based on an amalgamation of Postal CodeOM. Statistics Canada makes no representation or warranty as to, or validation of, the accuracy of any Postal CodeOM data.

DATA SOURCE 8:

Statistics Canada, Income Statistics Division, Annual Income Estimates for Census Families and Individuals (T1 Family File), Custom Tabulation

Postal Code Validation Disclaimer: The geography in T1FF request are derived based on an amalgamation of Postal CodeOM. Statistics Canada makes no representation or warranty as to, or validation of, the accuracy of any Postal CodeOM data.

Note: Only 14.5% of Families with income $20K-$39K claimed charitable donations while 76.8% of Families with income $250K or more claimed charitable donations.

DATA SOURCE 9:

Statistics Canada, Income Statistics Division, Annual Income Estimates for Census Families and Individuals (T1 Family File), Custom Tabulation

Postal Code Validation Disclaimer: The geography in T1FF request are derived based on an amalgamation of Postal CodeOM. Statistics Canada makes no representation or warranty as to, or validation of, the accuracy of any Postal CodeOM data.

Note: Only 2.3% of Families with less than $20K income claimed charitable donations while 76.8% of Families with income $250K or more claimed charitable donations.

DATA SOURCE 10:

CanadaHelps

DATA SOURCE 11:

Statistics Canada, Table 17-10-0005-01

Canada Revenue Agency, T1 Final Statistics