Understanding the Charities Directorate of the CRA:

Canada’s charitable sector is a powerful engine for social change and economic stability, touching almost every community in the country. From front-line service organizations to family-run foundations, registered charities play a critical role in tackling complex issues like poverty, education, health, and community wellbeing while also contributing billions of dollars to Canada’s GDP. This blog offers a practical overview of how the Charities Directorate supports the charitable sector, from registration and compliance to modernizing online filing, so your organization can stay focused on its mission while meeting regulatory requirements with confidence.

This blog is adapted from the presentation by Sharmila Khare, Director General of the Charities Directorate, during our webinar “Understanding the Charities Directorate of the CRA”. If you would like to watch the replay or review the slide deck in English/French, please follow the links below

Canada’s Charitable Sector Snapshot

The voluntary sector employs 2.7 million Canadians—about 1 in 10 workers—and contributes roughly 8.3% to GDP, or $225 billion annually. Canadians are also involved, donating over $11 billion in 2022, with businesses adding $4.2 billion in 2021 underscoring the sector’s economic and social impact. The “voluntary sector” is made up of both nonprofits and registered charities. Although the number fluctuates with new registrations and organizations winding down, it generally remains steady at approximately 86,000 registered charities at any given time.

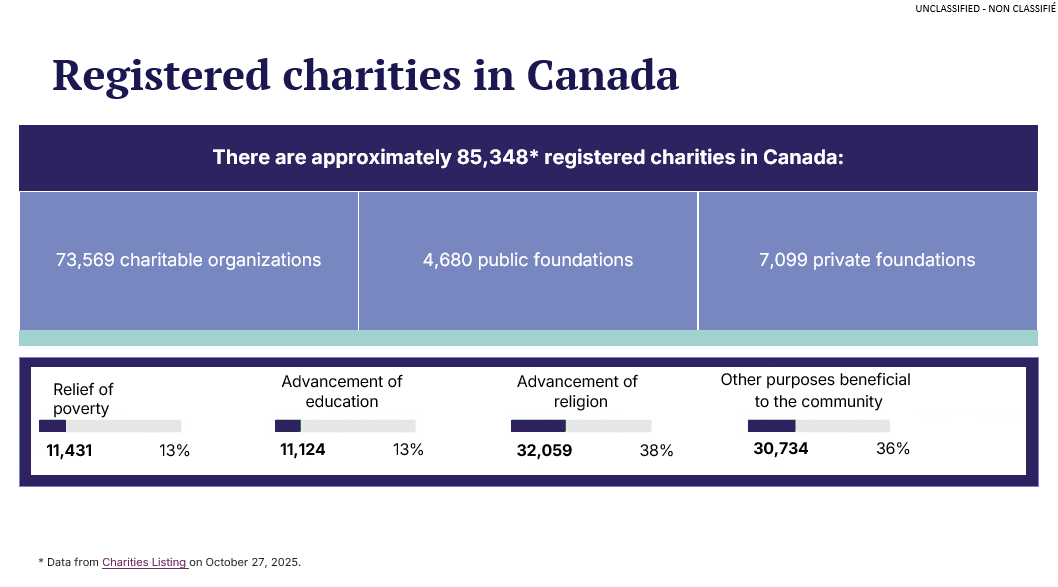

Registered charities can be broken down into:

- ~74,000 charitable organizations (The “doers” running programs and delivering services).

- ~4,700 public foundations (The “funders”, primarily granting to other charities).

- ~7,000 private foundations (Often family-controlled, acting as doers or funders)

About 13% focus on poverty relief, 13% on education, 38% on religion, and 36% on community causes like protecting the environment or promoting the arts. The diversity of our charitable sector shows how it meets a wide variety of needs across Canada.

The majority of Canadian charities are “small” with 73% managing under $1 million in assets. However, they often make a big impact in their communities.

The Charities Directorate Overview: Registration and Beyond

The Charities Directorate serves as Canada’s regulator of registered charities. Their role is to protect the integrity of the sector while supporting its vital contributions to Canadian society. This work involves more than just enforcing rules. It’s about enabling charities to thrive so they can continue to serve communities across the country and ensuring the charitable sector is one that the public feels confident in supporting.

The Charities Directorate is the area of the Canada Revenue Agency (CRA) that administers the sections of the Income Tax Act (ITA) that are related to the regulation of registered charities. Through this work, it:

- Registers charities under the ITA

- Educates the public and charities on the requirements for registration

- Protects the sector from being misused (e.g. money laundering, terrorist financing)

- Monitors the sector for compliance

- Carries out compliance actions

Beyond this, they also work behind the scenes on policy development and contribute to broader CRA initiatives that affect charities.

Registration Process

There are three main criteria for becoming a registered charity in Canada:

- Is the organization based in Canada?

- Is it established as a not-for-profit organization with charitable purposes under one or more of the four heads of charity?

- Relief of poverty

- Advancement of religion

- Advancement of education

- Other purposes beneficial to the community, which the courts have recognized as charitable

- Is it using its resources to carry out activities that align with those charitable purposes?

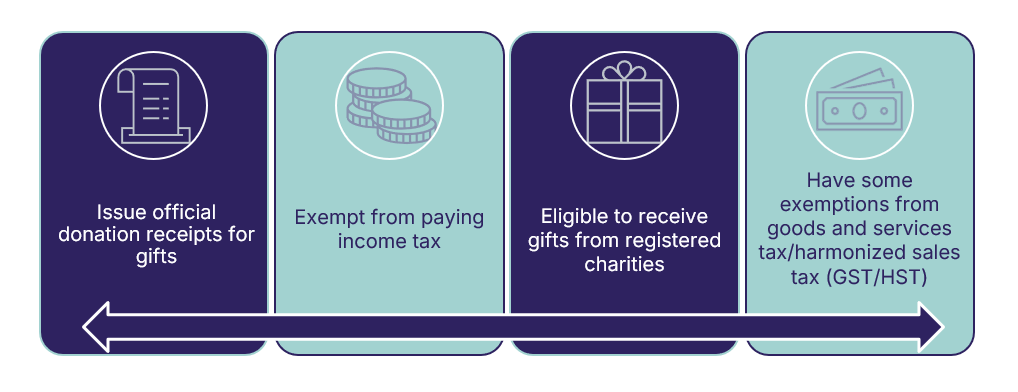

Once approved, charities gain benefits such as the ability to issue official donation receipts that donors can use for tax purposes, income tax exemption, receiving gifts from qualified donees, and potential GST/HST relief.

Registration is only a starting point for charities. To remain compliant they must:

- Engage only in allowable activities

- Keep adequate books and records

- Issue complete and accurate donation receipts

- Meet the annual spending requirement (disbursement quota or DQ)

- File the annual Form T3010, Registered Charity Information Return

- Maintain status as a legal entity

- Inform the Charities Directorate of any changes to their mode of operation or legal structure

T3010 Annual Filing Essentials

One of the key requirements for maintaining charitable status is filing a Form T3010, Registered Charity Information Return, along with all relevant supporting documents (such as financial statements, T1235 Directors/Trustees and Like Officials Worksheet, T1236 Qualified Donees Worksheet/Amounts provided to other organizations, and T1441 Qualifying Disbursements: Grants to Non-Qualified Donees Worksheet) within 6 months of an organization’s fiscal year-end. For example, a registered charity with a fiscal year end date of December 31 is required to file their annual return within six months, or, no later than June 30 the following year. Late or incomplete filings can result in revocation, which means losing the ability to issue official donation receipts, and the requirement to transfer all assets to one or more eligible donees or pay a 100% revocation tax, equal to the amount of all assets. If you ever need support or clarity in navigating this process, the Charities Directorate can support you.

The most reliable way to file your T3010 annual return is online through the My Business Account (MyBA) portal. MyBA:

- Helps avoid mail delays and/or lost returns

- Provides instant submission confirmation; financial information updates on the List of Charities within 24 hours

- Is an intuitive system with error-reducing prompts

- Displays progress is saved at each step

- Allows team access so any authorized individual(s) can contribute or review

- Provides built-in compliance: flags missing forms (such as the T1236, Qualified Donees Worksheet/Amounts provided to other organizations) based on answers

- Is secure, with sign-in partner options and quick password recovery

- NEW: In Spring 2026, there are expanded options to be able to file through CRA-certified third-party software

Common Compliance Issues to Avoid

Compliance helps to maintain transparency in the charitable sector, and in turn public trust to support charities. Most issues from the more than 82,000 returns received in 2022 were found to be fixable misunderstandings, like incomplete T3010s or disorganized records. In these cases the Directorate works collaboratively with charities to resolve them.

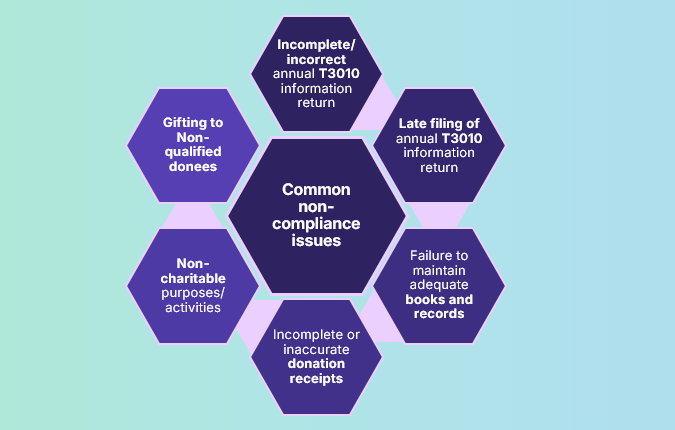

Common issues include:

- Incomplete/incorrect annual T3010 information return

- Late filing of annual T3010 information return

- Failure to maintain adequate books and records

- Incomplete or inaccurate donation receipts

- Non-charitable purposes/activities

- Gifting to non-qualified donees

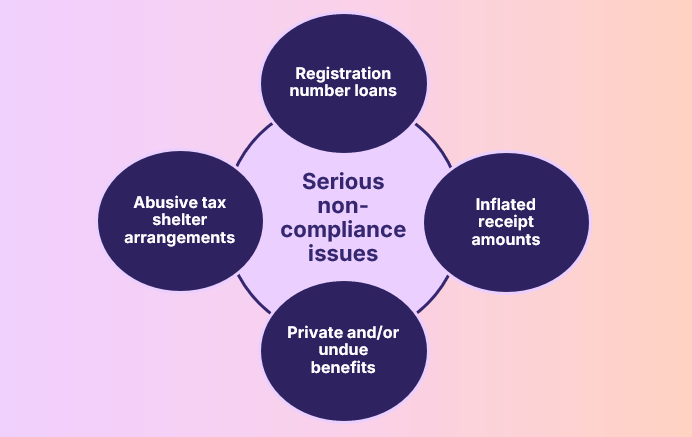

Serious non-compliance issues include:

- Registration number loans: misuse of receipting privileges e.g. lending a charitable registration number to affiliates and issuing receipts on behalf of another entity is strictly prohibited.

- Inflated receipt amounts: often arising from non-cash gifts that are over-estimated. Even if unintended, this undermines the tax system. If values cannot be substantiated, a receipt should not be issued.

- Private and/or undue benefits: benefitting directors/donors e.g. lavish places of worship in a private residence, missionary trips to luxury destinations with limited charitable activities, sound-alike charities that divert funds from legitimate causes.

- Abusive tax shelter arrangements: such as schemes issuing inflated donation receipts and promising participants tax savings while often providing little or no real charitable activity.

Compliance should be seen as a shared responsibility. The Charities Directorate does not have the capacity to audit every organization, nor is that the objective, as a healthy and transparent charitable sector benefits everyone. The Charities Directorate encourages you to bring forward concerns when they arise and are committed to listening and supporting, not punishing.

Increasing Online Filing

Currently, only 26% of charities file online. Comparatively, 93% of Canadians are filing their personal taxes online. Public opinion research commissioned by the Agency found that paper returns are often driven by habit or custom.

By filing online, you benefit from:

- Instant confirmation, you’ll know immediately once your return is submitted

- Next-day visibility – charities information updated in 24 hours once submitted

- Fewer errors – prompts and autofill features help reduce back-and-forth for corrections

- Built-in compliance – reminders for deadlines and missing information

- Flexible navigation – save your progress and file at your own pace

- Shared access – multiple authorized users can contribute

- Eco-friendly – no printing or postage that adds up to environmental impact

- Help from the CRA

To file online, go through your My Business Account (MyBA).

To use MyBA, you will need your Business Number (BN) and associated charity account (RR). To find specific steps on how to sign in, please visit the page “Access our online services for charities”.

This secure online portal also allows you to:

- Apply for registered charity status and track application progress

- File and amend annual returns

- Update organizational information, including address, directors, representatives, and governing documents

- Upload supporting documents and correspond with the Charities Directorate

- Access payroll and GST/HST accounts, file T4 slips and GST/HST returns, and view account balances and remittance details

Maintaining Compliance and Keeping In-Touch with the Charities Directorate

Maintaining your charity information is important because it shapes how the Charities Directorate keeps in contact with you. For some information, such as fiscal year-end changes, this requires approval.

- Name

- Telephone number

- Address

- Contact person

- Governing Documents

- Fiscal Year-End

Find the Agency’s Charities and giving webpage here:

- Registering for charitable or other qualified donee status

- Operating a registered charity

- Resources for maintaining charitable registration

- Previous webinars

- Annual Report

Did you know the Charities Directorate dedicated Client Service telephone support line answers inquiries in under 5 minutes?

1-800-267-2384

These representatives will be able to provide you with tailored guidance and answer any questions you may have concerning the operation of a registered charity.

Working in collaboration with the Charities Directorate and staying compliant as a registered charity is not just about avoiding penalties, it’s about protecting donor trust, safeguarding your organization’s reputation, and strengthening the entire sector. By understanding your obligations around annual T3010 filing, books and records, receipting, and the use of online tools like My Business Account (MyBA), your charity can reduce risk and free up more time and resources for impact. As you move forward, consider sharing these resources with your board, staff, and volunteers, and do not hesitate to connect with the Charities Directorate’s Client Service support line or subscribe to their updates so you can stay informed, compliant, and ready for what’s next.

Q&A Roundup

Q: Many charities have high turnover rates, what are the steps for password recovery for a charity’s My Business Account?

A: When you login to your CRA account, you will have options for forgot username or forgot password. You will have security questions that you can answered prior to retrieve access.

For more information, please visit the webpage “Register to use online services for charities”

Q: Is there any way to file online without a My Business Account?

A: No, the My Business account is a portal merged with the personal CRA account. It’s quite easy to log into your CRA account today using either your credentials or the “sign-in partner” feature which is integrated with banking institutions.

For more information, please visit the webpage “Filing a Registered Charity Information Return (T3010)”

Q: Is there a way to switch “signers” or “submitters” on an annual filing?

A: Yes, the information has to be certified by someone with the authority to sign off on behalf of the charity. This is something you can manage in your MyBA portal in the “designated individuals.”

For more information, please visit the webpage “Making a change to your organization”

Q: Does online filing include other necessary forms?

A: Yes, a great feature of the online filing is that it has built-in compliance. The moment you start completing your annual report online, based on your specific answers, you will be able to fill out other forms such as the T1236 if you made gifts to other qualified donees.

For more information, please visit the webpage “Filing a Registered Charity Information Return (T3010)”

Q: What are different types of designations and do they have implications?

A: For registered charities, there are three types of designations, the “charitable organizations”, the “public foundations” and the “private foundations”. These designations depend on your structure and how you operate. If your structure changes, you can contact us to request a change. They all have the same abilities as registered charities. This is separate from not-for-profit organizations.

For more information, please visit the webpage “Types of registered charities (designations)”

Q: Is “advancing religion” becoming less acceptable as a charitable purpose?

A: No, a recommendation was made to remove it in 2025 by the House of Commons Finance Committee but the Government recently confirmed it is not considering any changes.

Q: What is the process for a gift in-kind receipt?

A: To put it simply, any gift in-kind (i.e. not cash) would require the organization and/or the donor to establish the fair market value of the gift – usually the highest price it would bring on the open market. This is the most important part of issuing a tax receipt for a gift in-kind.

For more information, please visit the webpage “Determining the fair market value of non-cash gifts”

Q: What is the process for gifts in-kind which are services?

A: If you are referring to services, it should be done as two separate transactions. Charities are within their rights to pay for services. Once they have paid and invoiced for that service, if the business would like to donate a portion or all of that money back to the organization, then it becomes a gift like any other which allows the registered charity to issue a receipt for that gift.

For more information, please visit the webpage “Gifts of services”

Q: What is the disbursement quota and how is it calculated?

A: The disbursement quota is to ensure charitable dollars are being used appropriately for public benefit and not indeterminately held. It is based on property not used in the organization’s charitable activities.

For more information, please visit the webpage “Annual spending requirement (disbursement quota)”

Q: What are obligations for a charity winding down its operations?

A: The winding down period starts with a voluntary revocation request, which you can submit through the My Business account. Common reasons could include either mergers, completing your mission, or a lack of resources. The CRA will begin the winding up period, by issuing a T2051 letter. During this period, you have to complete and file a T2046 and pay revocation tax. The revocation tax would be the tax that is equal to 100% of the value of all remaining assets and after you have paid all your debts of course. We will also be required to complete all outstanding T3010 returns.

For more information, please visit the webpage “Request voluntary revocation”